China’s rapidly evolving financial landscape has seen the emergence of an innovative instrument designed to channel capital toward high‑growth industries: the so‑called “Innovation Bonds.” These specialized debt securities, backed by government guarantees and targeted subsidies, aim to support technology firms, research institutions, and start‑ups that drive the nation’s strategic economic goals. With a dual focus on catalyzing research and development while managing credit risk, Innovation Bonds are quickly becoming a cornerstone in Beijing’s toolkit for sustaining long‑term industrial transformation.

The Genesis of Innovation Bonds

In the wake of slowing global demand and increased international competition, Chinese policymakers have prioritized innovation‑driven growth. Traditional financing channels bank loans, equity markets, and state grants proved insufficient to meet the surging capital needs of technology ventures. To bridge this funding gap, the government introduced Innovation Bonds in late 2023, blending market discipline with policy support.

Key design features include:

A. Government Credit Enhancement: Central and local financial authorities provide guarantees or partial guarantees, lowering borrowing costs for issuers.

B. Project‑Specific Proceeds: Bond proceeds are ring‑fenced for R&D expenditures, procurement of advanced equipment, or commercialization of patented technologies.

C. Preferential Tax Treatment: Interest income received by qualified investors may be exempt from certain local taxes, enhancing yield attractiveness.

D. Dynamic Evaluation Criteria: Independent rating agencies assess the issuer’s innovation capacity, patent portfolio strength, and management track record.

These elements align issuer incentives with national priorities, allowing the state to steer private capital toward sectors deemed critical for economic security.

How Innovation Bonds Differ from Traditional Corporate Debt

Although structurally similar to standard corporate bonds, Innovation Bonds incorporate unique policy overlays that distinguish them in several ways:

A. Risk Mitigation Mechanisms: Government credit enhancements reduce default probability, tightening yield spreads relative to unguaranteed notes.

B. Use‑of‑Funds Clauses: Strict covenants ensure funds are deployed in pre‑approved innovation activities rather than general working capital.

C. Regulatory Flexibility: Under special exemptions, issuers can tap reserved bond quotas beyond the conventional issuance ceilings.

D. Performance‑Linked Subsidies: Issuers demonstrating milestone achievements may receive partial interest rebates or direct R&D grants.

Combined, these provisions make Innovation Bonds an attractive source of capital for technology firms that may lack substantial collateral or consistent cash flows.

Market Reception and Issuance Trends

Since their debut, Innovation Bonds have witnessed robust demand from both institutional and high‑net‑worth investors. As of Q1 2025, cumulative issuance surpassed CNY 350 billion, spanning multiple sectors—from semiconductors and biotechnology to artificial intelligence and renewable energy.

Highlights include:

A. Leading Issuers: State‑owned research institutes, large tech conglomerates, and nimble private start‑ups have all tapped the market.

B. Investor Base: Fund managers, insurance companies, and specialized bond funds account for the lion’s share of allocations.

C. Yield Profile: Average coupon rates range between 3.5% and 5.0%, reflecting substantial credit support and tax incentives.

D. Geographic Spread: Issuance activities have expanded from major hubs like Shanghai and Shenzhen into emerging innovation clusters in Chengdu and Hefei.

This widespread uptake underscores the appeal of a financing instrument that balances risk and reward with explicit strategic objectives.

Channeling Capital into High‑Priority Sectors

Beijing has identified several sectors where Innovation Bond proceeds should be concentrated, aligning funding flows with broader industrial policy aims:

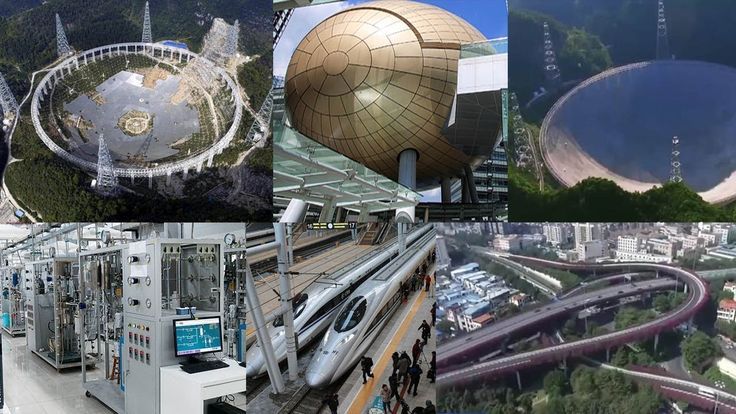

A. Advanced Manufacturing: Automation, robotics, and smart factory infrastructure to enhance productivity and on‑shoring capabilities.

B. Semiconductor Research: Chip design, fabrication equipment, and material sciences to reduce dependency on foreign suppliers.

C. Biotechnology and Pharmaceuticals: Gene editing, vaccine research, and traditional‑medicine modernization for health security.

D. Renewable Energy and Environmental Tech: Solar modules, battery storage, carbon capture, and pollution control technologies.

E. Artificial Intelligence and Big Data: Machine learning algorithms, cloud computing infrastructure, and industry‑specific AI applications.

F. Quantum Computing and Advanced Materials: Fundamental research with potential long‑term breakthroughs in computing power and material science.

Issuers must demonstrate how bond‑financed projects will deliver on national targets such as reducing carbon intensity or achieving semiconductor self‑sufficiency within specified timelines.

Case Studies of Impact

- High-Speed Rail Control Systems: A consortium led by a state research institute issued CNY 2 billion of Innovation Bonds to develop next‑gen signaling software. Within 18 months, the project achieved substantial safety improvements and was licensed to five regional rail operators.

- Biomanufacturing Hub: A private biotech start‑up raised CNY 500 million, subsidized by interest rebates, to build a pilot plant for cell‑cultured meat. The facility now produces over 10 metric tons of protein annually, attracting further private equity rounds.

- AI‑Enabled Agricultural Drones: A technology incubator tapped CNY 300 million in bonds to scale drone‑based crop monitoring and precision‑spraying solutions. Farmers in Zhejiang province report yield increases of up to 20%.

These success stories illustrate how targeted financing accelerates commercialization and market adoption.

Challenges and Risk Considerations

Despite early triumphs, Innovation Bonds face several hurdles:

A. Quality Assurance: Ensuring proceeds are used effectively requires rigorous monitoring, which can strain local government resources.

B. Credit Risk Concentration: Heavy reliance on government guarantees may mask underlying issuer vulnerabilities, leading to moral hazard.

C. Market Saturation: Rapid expansion of issuance quotas could dilute credit enhancement benefits if underwriting standards slip.

D. Interest Rate Sensitivity: In a rising rate environment, even guaranteed bonds may confront capital losses and reduced demand.

E. Regulatory Uncertainty: Future policy shifts such as changes to tax incentives may alter the risk‑reward calculus for investors.

Stakeholders must remain vigilant to balance innovation objectives with sound risk management.

The Road Ahead: Scaling and Sustainability

To maintain momentum, policymakers and market participants are exploring enhancements:

A. Digital Bond Platforms: Leveraging blockchain technology to enhance transparency in fund flows and project milestones.

B. Green Innovation Linkages: Integrating Innovation Bonds with green bond frameworks to attract ESG‑focused investors.

C. Cross‑Border Offerings: Piloting offshore issuances to tap global capital markets and diversify the investor base.

D. Secondary Market Development: Encouraging market‑making activities to boost liquidity and price discovery.

E. Performance‑Based Pricing: Linking coupon rates dynamically to project outcomes, fostering accountability.

By evolving the instrument, China aims to establish a sustainable financing ecosystem that underpins its ambition to become a global innovation leader.

Conclusion

Innovation Bonds represent a strategic fusion of policy support and market mechanisms, channeling critical funding into technology sectors that will define China’s economic future. While challenges remain—particularly around execution oversight and market maturity the rapid growth of issuance volumes and diverse investor participation signal strong validation of the concept. As Beijing refines the framework, Innovation Bonds are poised to become a permanent fixture in the nation’s capital markets, fuelling breakthroughs in semiconductors, biotech, renewable energy, and beyond.